Commercial Real Estate to Play an Important Role in Economic Recovery

By Mathew Tiller, Head of Research, LJ Hooker Group

Volatility, regulations, disruptions and shifting financial market conditions, experienced over recent years, has failed to dent the performance of commercial real estate assets. One reason for this stability is that commercial property plays an important part in how we work, live and play. From working in an office, to visiting a café, shopping at a supermarket or ordering goods, via a warehouse, online. While the long-term nature of commercial real estate investment and leases means it is less volatile in the short term.

More recently, conditions for businesses have improved, as governments move away from pandemic related lockdowns and restrictions. This has seen household spending increase as people return to their favourite pubs, restaurants, cafes and entertainment venues and begin to travel. This has in turn seen retail turnover rise which has been a boon for businesses with revenues and company profits picking up from the low’s experienced in early 2020.

That being said, it’s not all smooth sailing for business owners; while low unemployment has been a positive driver of higher household spending, it has also caused a bottleneck for business activity, growth and expansion. High levels of inflation – driven by domestic demand and global supply issues – has seen input costs – including interest rates - and prices rise which, in turn, has also placed pressure on business budgets, cashflow and profitability.

Each commercial property sector has been differently affected by these economic conditions and, in turn, have differing performances and outlooks.

Office

Suburban and regional office space to remain popular

Office real estate markets have continued to slowly rebound from the disruptions caused by lockdowns and government restrictions which forced employees to work from home. The past 12-months has seen businesses reformulate working arrangements for staff, determining what level of office attendance they require from their employees to nurture productivity, cohesion and culture. The majority of businesses, to date, have opted for a hybrid work approach whereby employees attend the office two or three days a week and work from home the remainder.

Office markets have also benefited from strong employment drivers and positive economic growth. “White collar” employment – which drives office vacancy rates – has begun to pick-up strongly over the past two years. The number of people employed in the financial and insurance services industry, which is a big occupier of office space, particularly in CBD markets, has risen 15%, or 71,000 people, since March 2020.

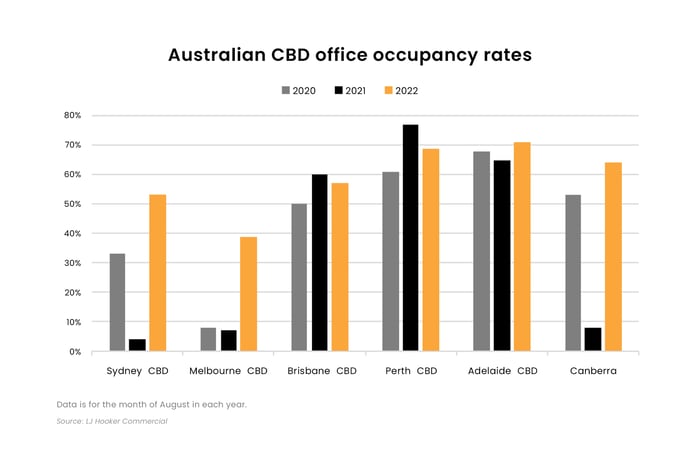

Despite a more positive outlook for office space, the combination of WFH and the ability of employees to negotiate flexible contracts due to tight labour markets has seen occupancy rates rise slower than expected for CBD offices markets. According to the Property Council of Australia’s latest data, the Adelaide and Perth CBD office markets have been the most resilient with occupancy rates currently at 71% and 69% respectively. Melbourne CBD has been the most impacted by restrictions with occupancy curtly sitting at 39%.

Two major trends we expected to continue for office space are:

Flight to quality in CBDs

Businesses will continue to look to attract talent by occupying the best office space their budget will allow. Given businesses are now looking for less space due to WFH arrangements, they can now afford higher quality space within CBD market. This means Prime Grade space in our CBD will see a faster rebound in performance than lower quality space.

Flight to metro, suburban and regional space from CBD

WFH arrangements will also see businesses re-evaluate where their staff reside and move closer to them in order to reduce commute times and attract employees back into the office. This means major metropolitan, large suburb and regional office markets will continue to see higher than average demand from businesses looking to do this.

Retail

Retailers have been one of the most adaptive to changing economic and regulatory conditions over the past two years. Regulations and legislation changed how:

- retail businesses could operate;

- consumers could interact with these businesses.

As a result, retailers had to adapt, transform, and innovate to ensure they could remain open and connect with their customers.

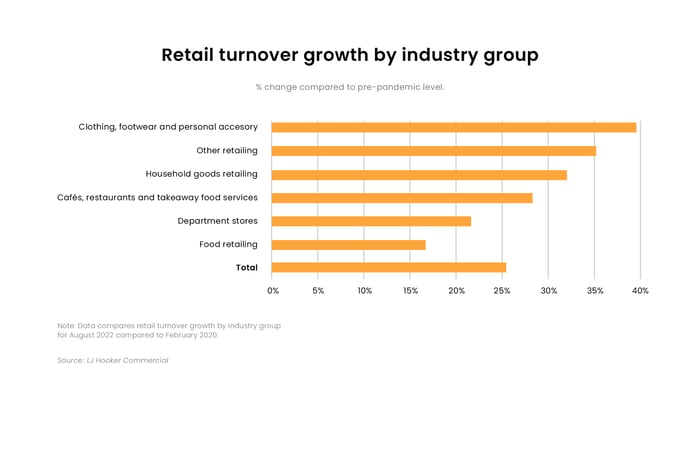

Dine-only restaurants shifted their operations to incorporate take-away and delivery services; bricks and mortar retailers expanded their online presence; and businesses expanded their offering to encompass new, in-demand, products and services. The lifting of government restrictions and a move away from lockdowns, combined with a large build-up of household savings, has benefited retail businesses. This has seen retail turnover continue to grow and substantially outpace pre-pandemic levels.

This economic growth and increase in turnover have also been positive from a retail real estate perspective. The key metrics of retail performance - releasing spreads, vacancy rates and portfolio valuations - from some of Australia’s major shopping centre owners have all improved over the past year. Rents have stabilised as trade conditions have improved and yields have tightened, particularly in high-quality suburban centres.

Looking forward, households’ budgets will come under some pressure and spending will tighten as interest rates continue to rise and cost of living pressures bite. This is expected to take some wind out of the retail spending sail but will remain positive overall. That said, demand for retail space from small strip retail tenants to larger national retailers will continue to improve as business conditions normalise, revenues improve and profitability rises.

Industrial

Structural changes to our economy have been very positive for industrial real estate assets across the country. The changes in the way households purchase items and the way in which businesses operate has seen demand for industrial space, of all sizes, rise strongly over the past two years.

This strength has seen the investment fundamentals for industrial property improve:

- Lower vacancy rates have driven higher rental growth

- Interest from investors and owner-occupiers have driven yields tighter and capital values higher

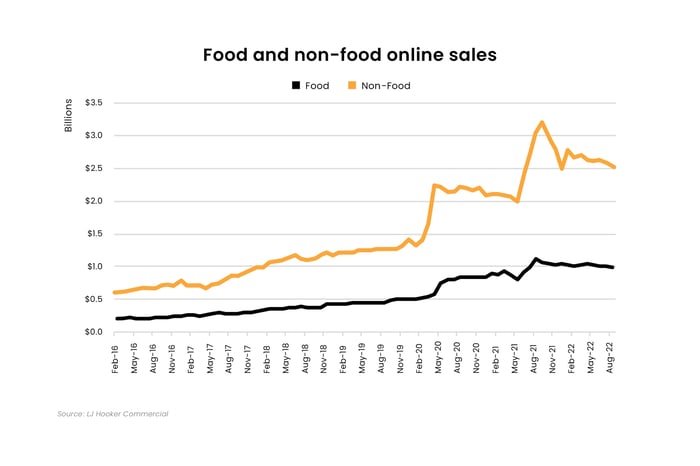

One major driver of improved performance of industrial markets has been the strong uptake and expansion from transport and logistics operators. Demand for their services has skyrocketed in line with retailers moving more of their operations online.

This has seen demand for expansion space from these industries push higher. Additionally, the disruption to supply chains has also seen business enquire about taking up more space to store additional inventory, protecting their businesses from global supply chain issues.

Looking ahead, the expansion of online retail business, as well as higher industrial space demand from food retailers, will be key drivers of markets over the medium term.

Online spending to keep industrial demand elevated

According to latest data from the ABS, online spending totalled $3.5 billion in August 2022. This result was 82% higher than before the pandemic (February 2020) and 104% higher than August 2019. This growth has seen a knock-on effect to the transport and logistics firms that deliver goods for retailers. Online spending is expected to grow at close to double-digit pace until the middle of the decade, underpinning demand from these occupiers. In addition, the trend of online spending will also encourage ongoing investment from industrial property occupants and landlords in more efficient warehousing and delivery services to satisfy their customers.

Food retailing will drive investment in building fit-for-purpose assets

Food retail spending has increased at a rapid pace over the past 18 months, driving higher demand for suitable industrial space. The ABS shows that food retailing totalled $13.4 billion for the month of August 2022 - 20% higher than August 2019, before the pandemic. This growth has seen demand for purpose-built cold and room temperature storage facilities increase. Given food retailing is set to increase in line with higher population growth and improved supply chains will bring down raw food prices and production costs, so will the demand for suitable storage space and facilities.

Share

%20copy-1.png)