Employment Provides Positive Outlook for Commercial Markets

Australian commercial property markets have faced significant challenges in recent years. High inflation, rising interest rates, declining bond returns, global conflicts, and geopolitical actions have all combined to increase market uncertainty. Despite these challenges, the market has also witnessed new opportunities and structural shifts that have positively impacted commercial real estate assets.

One of the primary drivers of change, in the Australian commercial real estate market, over the past year and into the future is employment. The COVID-19 pandemic has disrupted various industries, leading to changes in the way they work, resulting in shortages of workers and higher costs of employing them. As a result, businesses are now focusing on ensuring their workplaces attract and retain top talent in a highly competitive labour market by allocating more of their rental budgets towards creating an attractive work environment.

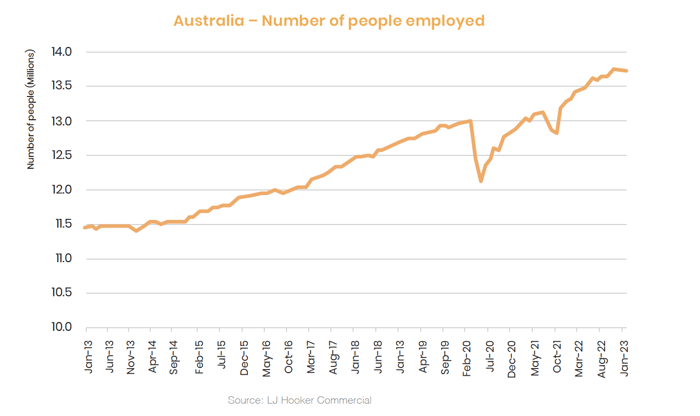

Since peaking at 7.50% in July 2020, due to pandemic-related restrictions, the unemployment rate in Australia has remained below 4%. In January 2023, the number of people employed had increased by 5.6% compared to pre-pandemic levels in March 2020, equating to an additional 730,000 people in employment. While the past few years have seen a significant shift in where people work, whether it be from home, the office, the shop or the shed, the need for a physical space to conduct work remains unchanged. As a result of the structural changes caused by COVID-19, there has been a shift in demand for commercial real estate and the way in which it is used.

Office

The pandemic has had a significant impact on office markets, starting with stay-at-home orders which evolved into the work-from-home movement. The ongoing tightness of employment markets has given employees the upper hand in contract negotiations, enabling them to work from home partly, or permanently. Nevertheless, work patterns are gradually returning to normal, with workers returning to the office more regularly. This is evident in the ever-improving office occupancy rates.

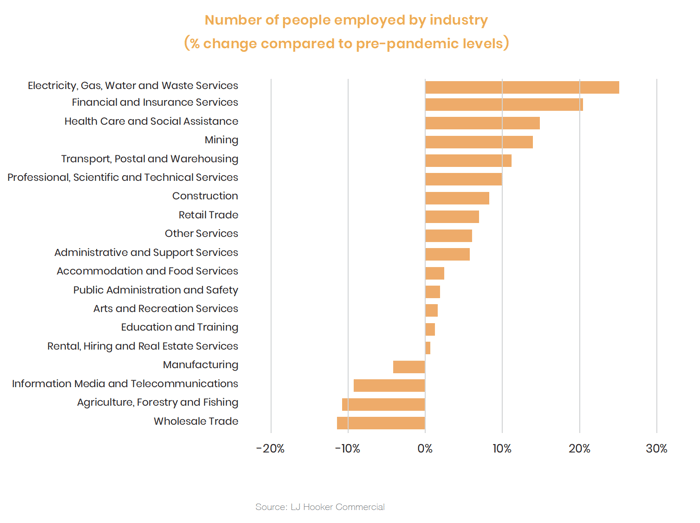

As businesses have established their work-from-home policies, they have realised that many employees still value the social aspect of office life and desire the opportunity to socialise with their colleagues. Moreover, many companies have identified the limitations of working from home, where certain tasks are more effectively done in the office environment. Consequently, the demand for office space is beginning to rise, and many companies are now looking to lease office space to facilitate a hybrid working model. In addition, white-collar industries that occupy a significant amount of CBD office space have experienced strong growth in employment numbers. The financial and insurance sector, for instance, has seen an 8% rise in employment over the past year. This trend is further driving the demand for office space as companies expand their operations and require more space for their employees.

One significant trend that has emerged is the increased demand for flexible lease arrangements and flexible office space, such as co-working spaces and serviced offices. These types of spaces allow businesses to have access to high-quality office facilities without the burden of long-term leases and high upfront costs. Many startups and small businesses have found these spaces to be an excellent solution to their office space needs.

Retail

Over the past year, Australian retail real estate markets have shown significant improvement as businesses return to normal trading conditions, after pandemic induced lockdowns. More positive trading conditions are seeing new businesses begin to open and in turn has seen a 4% growth in retail employment over the past year. This growth is driving demand for retail leases, particularly in suburban areas. Over the past year, the shortage of workers in CBD office buildings had a significant impact on retailers and retail assets within these markets. Small businesses that rely on workers were particularly affected, as were vacancy rates and values of retail assets. However, the retail market has seen a gradual improvement with the return of office workers to their workplaces. This is evident in the improvement in vacancy rates, leasing spreads and rental rates.

Despite these positive developments, retail real estate markets still face challenges. The rise of e-commerce has led to an oversupply of retail space in some areas, particularly in shopping centres. As such, landlords and developers must be innovative in their approach to leasing and attracting tenants to these spaces. Additionally, ongoing economic uncertainty, cost of living pressures and higher interest rates will impact consumer spending, which would have a knock-on effect on the retail sector. Overall, the Australian retail real estate market has shown resilience and adaptability in the face of challenges posed by the pandemic and changing consumer behaviours. The return of workers to CBD office buildings and increased demand for suburban retail space bodes well for the future of this sector.

Industrial

The industrial real estate market in Australia has experienced a significant boost in demand due to the rise of online retailing and the preference for households to shop online. The growth in e-commerce has led to an increase in demand for transport and logistics businesses, which require more warehouse and storage space. This has resulted in a surge in employment within the logistics industry, leading to higher tenant demand for industrial real estate. Furthermore, the growth in transport and logistics has not only been driven by e-commerce but also by the need to accommodate the expansion of global trade. The rise in international trade has led to an increase in demand for industrial properties, particularly in areas with good access to ports and transport infrastructure. Employment data shows the growth of these businesses with the number of people employed in the transport, postal and warehousing industry rising by 11% over the past year.

As a result of these trends, the industrial real estate market has been one of the strongest performing sectors in the Australian commercial property market in recent years. This has been reflected in rising occupancy rates and rental values across major industrial markets. Industrial real estate market is expected to continue to benefit from the growth of e-commerce and the logistics industry, particularly in areas with good transport infrastructure and proximity to major ports. As businesses continue to expand their online operations, the demand for industrial real estate is likely to remain strong.

Looking forward, commercial real estate markets will continue to face challenges and present opportunities over the medium term. From a domestic perspective, factors such as changes in interest rates, shifts in consumer behaviour, and fluctuations in the labour market will impact the performance of commercial properties in various sectors. Additionally, global economic trends, such as fluctuations in commodity prices, geopolitical disputes, and shifts in global supply chains, will also have an impact on the Australian commercial real estate market.

Despite these challenges, there are also many opportunities for growth and success in the industry. For instance, the ongoing trend towards e-commerce and the need for efficient logistics and warehousing facilities will continue to drive demand for industrial properties. Similarly, as the workforce returns to the office, there will be renewed demand for commercial office space in CBD areas. And as the population continues to grow, demand for retail space in both urban and suburban areas is likely to remain strong.

Read more market insights in our Commercial Magazine here, and find all the latest commercial properties for sale and lease.

Share

.png)