Office Recovery Continues With Rents on an Upward Trend

-Nov-29-2022-11-41-35-5478-PM.png?width=1200&height=628&name=Website%20feature%20image%20spec%20size%20(1)-Nov-29-2022-11-41-35-5478-PM.png)

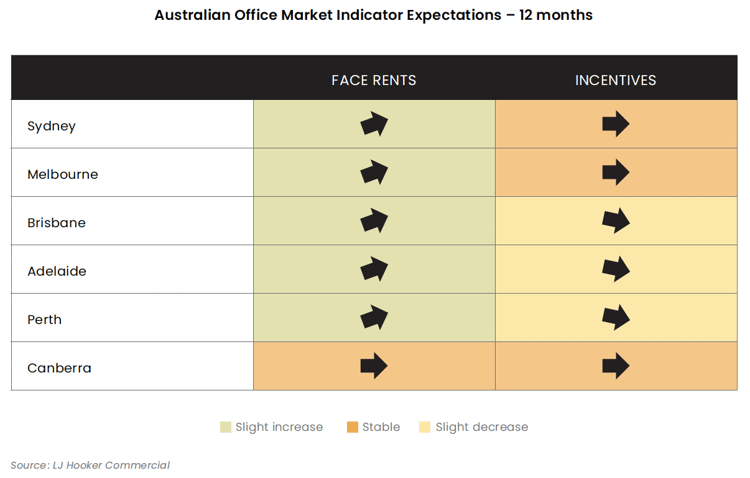

Prime office rents will edge upward over 2023 despite the lingering work from home movement, according to LJ Hooker Commercial’s latest Office Market Monitor.

As the sector’s slow recovery continues, landlords will continue to opt for face rent increases to protect their income streams while being flexible on incentives. However, the trend of generous incentives will begin to taper-off toward the end of 2023 as global conditions improve, the Monitor predicted.

Prime grade office has proved the most resilient stock within the asset, with the flight to quality driven by employers who are looking to entice staff back to the workplace and combat rising energy prices.

The preference for high grade office has created challenges for non-CBD office landlords. Some businesses are choosing to close their smaller satellite offices, allowing staff to work from home.

LJ Hooker Group’s Head of Research, Mathew Tiller, said the office sector’s recovery was underway but still a long way from pre-pandemic occupancy.

The leading office markets of Sydney and Melbourne have recorded incremental increases in rents but Brisbane – with mining performing strongly and tourism in recovery – recorded the fastest growth on rents this year, albeit from a low base.

“The upward trend in rents may surprise tenants who are coming off leases, but it’s a reflection of landlords wanting to peg their agreements to CPI; incentives remain traditionally high,” he said.

Leases were still being negotiated, but occupiers were uncertain how much space they needed, said Mr Tiller.

“Employers are grappling with the post-pandemic office pattern which has made Tuesday to Thursday the peak days in the CBD, while Mondays and Fridays are quieter.

“Workers expect a desk when they come into the office. So, tenants must determine whether they’ll stretch their outgoings to ensure everyone is happy or take less space and try to manage frustrations on peak days.

“The indecision is compounded by inflation and a global outlook that will place some businesses under pressure in 2023.”

Mr Tiller said employers felt greater pressure to entice their staff back to the office. If workers were going to commute more regularly, they were going to expect premium amenities like spacious kitchens, break-out rooms, end-of trip facilities and proximity to public transport.

Mr Tiller said the ESG credentials of buildings were also a major consideration for tenants as energy costs soar.

From an investment perspective, Mr Tiller said capitalisation rates were weaker in office than industrial and retail asset classes.

“With monetary policy in its current cycle and a reluctance by many workers to come back to the office fulltime, capitalisation rates are expected to be soft over the next 12 months,” he said.

The Monitor predicted the office market would improve in 2024 on the back of global economic improvements.

To read the full Office Market Monitor report, click here.

Share

-3.png)

.jpg)