Commercial Real Estate in 2021 - Regional Opportunities Abound

One field of theory that has been fascinating to study over this past year is the field of behavioural economics. Behavioural economics is effectively the study of how psychology impacts economic decision-making processes of individuals and institutions. In normal times, we see incremental changes in behavioural economic trends over long periods of time - humans, after all, are creatures of habit. And habits, especially amongst large populations, take a long time to change. At its onset, COVID-19, and the lockdown imposed on Australians as a result, forced immediate changes to our habits, virtually overnight. Now that lockdowns have eased around the country, and the threat of Covid-19 is waning as vaccinations are rolled out, we can measure what aspects of human economic behaviour have changed for good. So let's take a look at some of the changes that have occurred, and what these could mean for commercial property owners, developers and tenants.

A desire for space and fresh air

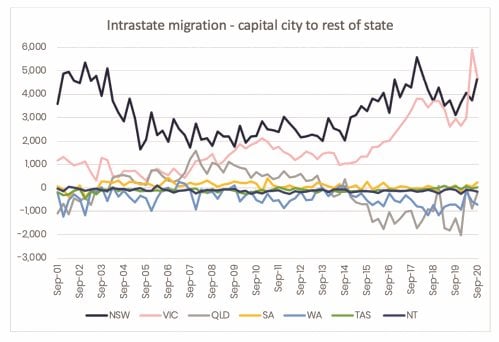

Australia has always been blessed with an abundance of space and fresh air. Indeed, it is something our country is famous for. However, there is now data to support the conclusion that Australians are acting on this desire through increasing migration to non-Capital City areas. In NSW, migration from Sydney to the rest of state has been steadily gathering pace for around 6 years. Since September 2014, regional NSW has recorded a net gain of almost 100,000 Sydney-siders as residents.

The trends in Victoria broadly mirror those of NSW, although Melbourne has traditionally lost less migrants to rural Victorian areas than Sydney has. This trend changed dramatically over the June 2020 quarter, when there was a massive surge in Melburnians moving to rural Victorian areas. Over the 6 months to March 2020, a net 5,622 Melburnians left for rural Victoria. Over the 6 months to September 2020, that figure increased to 10,604 Melburnians making the move.

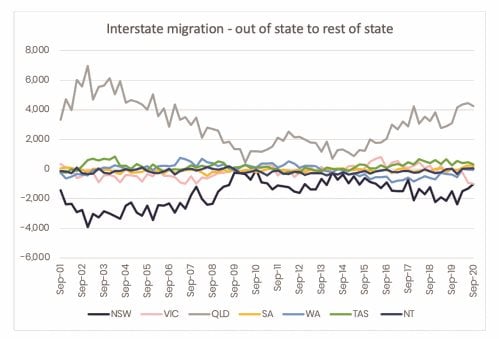

The story is very different in Queensland, with more people moving from regional Queensland areas to Brisbane, than the other way around. However, rural Queensland is a notable outlier in interstate migration {that is, non-Queenslanders moving to rest of state Queensland). When we look at this data, a similar timeline is seen as in NSW and Vic - a surge in people movements from around late 2014. This means that any loss of residents from rural Queensland to Brisbane is more than made up by movements of interstate migrants to rural Queensland.

Long term people movements and any impact of COVID-19 is less obvious in the other states, with the exception of Tasmania. Rest of State Tasmania (i.e. areas outside of Hobart) have been gradually gaining more and more migrants since late 2016. This trend continued throughout 2020, and is being driven by the desire of Australians to gain more space at an affordable price.

This analysis, it should be noted, deliberately avoids the major impact that overseas migration has had on Australian population changes over the past few years. Whilst the data does show us that rural NSW, Victoria, Queensland and Tasmania have all been gaining migrants from capital cities, what it ignores is that prior to 2020 Sydney and Melbourne have more than compensated for this loss by the arrival of overseas migrants. This is why commercial and residential property prices in these markets have continued to grow substantially.

So why is this movement of people within and around Australia important to understand? The purpose of commercial property, at it's core, is to service populations. As the saying goes, demographics is destiny. And as our national borders remain closed until at least June 2021, these intra and interstate movements of people have never been more relevant to understanding future commercial property trends.

What makes a great non-CBD commercial property opportunity?

Now that we have established that there is a clear trend of growing populations in rural areas, at the expense of capital cities, we can further narrow the focus to understanding the opportunity for commercial property growth by focussing on what other factors these markets need.

Infrastructure

Commercial property is almost a conduit for the movement of people, freight, goods, services and even technology (in the case of data centres). While some of this can be done remotely, not all of it can be, and this is why locations close to good transport infrastructure are imperative. Even for commercial property that provides a service (notably, office), at some point, people do need to get up and leave their desk to meet or visit clients or other service providers.Regional areas with direct train and road linkages to capital cities tend to be first preference locations for people, and therefore commercial property occupiers.

Regional airports will likely play a much bigger role going forward, as commercial operators can utilise airports such as Toowoomba Wellcamp Airport, Avalon Airport, Taree Airport. Already the federal government is recognising the importance of regional airports and is investing $41.2 million in 60 regional airports to assist the aviation industry through the COVI D-19 pandemic. Over the next four years, this figure is expected to grow to $100 million.

Lifestyle

Regional areas that offer similar services to cities and their suburbs but with a more relaxed lifestyle are already in strong demand from residents. Having good schools, existing retail, childcare, aged care, healthcare and services will all help a commercial business operator feel comfortable about establishing a long term presence in the area, as they will be confident of attracting the right staff. We already see the impact of lifestyle attracted buyers in the Mid North Coast region of NSW.

What are the commercial real estate opportunities?

It is likely that 2021 will present some of the best conditions for commercial property growth in regional Australian areas that we have ever seen. The unique demographic and behavioural drivers are all pointing to increased movement of people outside of capital cities, and it is likely that key areas blessed with lifestyle and great transportation opportunities will attract commercial occupiers to capitalise on these trends. We have considered below where the best opportunities might lie for each asset class: Office

Co-working and serviced office type space should see good take up. Both companies and individual contractors will be less inclined to commit to long term leases in traditional office space, and co-working is a great solution for white collar workers to access the office they need, without the long term commitment they are trying to avoid. The co-working spaces are located in amongst existing retail and close to transport, so this is a great opportunity for those larger retail spaces that may have been vacated recently. Better office space in regional areas will also act as encouragement for businesses to create a permanent presence in regional areas, as lack of this type of space has previously been an impediment to generating a white collar workforce.

Retail

While the online shopping phenomenon took Australia by storm over 2020, non-discretionary retail (mainly food, beverage, hardware) still very much has a place in bricks and mortar retail premises. As populations in regional towns increase, so will the demand for non-discretionary retail. Large Format Retail, which are very common in suburbs but less so in regional towns, should do well out of this trend. Discretionary retail will likely continue to feel the impact from online shopping, however services that people are used to in cities will make up some of the shortfall in demand in retail space.

Industrial

his sector has gone from strength to strength thanks to the online shopping 'revolution' of 2020. All those purchases need to be stored along their way to their eventual destination. Major distribution centres will still be located close to the big ports and airports in the cities, but expect to see smaller fulfilment centres along high growth corridors such as the NSW Central Coast, Victoria's Mornington and Bellarine Peninsulas, and the Sunshine Coast in Old. Modern high clear span warehouses ideally along a freeway corridor should be met with good demand.

Share